- Home

- TVS Supply Chain IPO Last date, Price Range, GMP, Subscription Rate, About Company Full Detail

TVS Supply Chain IPO Last date, Price Range, GMP, Subscription Rate, About Company Full Detail

The TVS Supply Chain Solutions Initial Public Offering (IPO) is creating a buzz in the market as the last date for subscriptions approaches. Scheduled to close on August 14, 2023, the IPO has garnered attention due to its attractive price range, grey market premium (GMP), and subscription rate. This article provides a comprehensive overview of the TVS Supply Chain IPO, covering key details such as the IPO’s closing date, price range, grey market premium, subscription rate, and an in-depth look into the company’s background, operations, and objectives. Whether you’re a potential investor or simply curious about the IPO market, this article offers valuable insights into one of the notable IPOs in the market.

TVS Supply Chain IPO

The TVS Supply Chain Solutions IPO is open for investment until August 14, 2023. With shares priced between ₹187 and ₹197 each, the IPO has generated a lot of interest, as indicated by the ₹25 grey market premium. The subscription rate is also rising, showing strong demand. It’s an opportunity for investors to be part of the company’s growth in the supply chain sector.

| TVS Supply Chain Solutions IPO | Details |

|---|---|

| Category | Stock Market |

| Start IPO Date | August 10, 2023 |

| Last IPO Date | August 14, 2023 |

| Listing Date | August 23, 2023 (Expected) |

| Face Value | ₹1 per share |

| Price Range | ₹187 to ₹197 per share |

| Min. Lot Size | 1 lot/76 Shares |

| Issue Type | Book Built Issue IPO |

| Listing Platforms | BSE, NSE |

TVS Supply Chain IPO Last Date

The last date to subscribe to the TVS Supply Chain Solutions IPO is August 14, 2023. If you’re considering investing in the TVS Supply Chain IPO, make sure to complete your application before this closing date. It’s a chance to potentially be a part of the company’s journey in the supply chain management industry.

TVS Supply Chain’s IPO Price Range

The TVS Supply Chain Solutions IPO presents a price range of ₹187 to ₹197 per share, allowing investors to purchase shares at different price points within this range. For instance, investing ₹187 per share would amount to ₹14,212 for 76 shares. This flexible pricing structure caters to various investment preferences and budgets, offering an opportunity to be part of the company’s journey in the supply chain industry.

| Join Telegram For Stock Market updates. | Join |

TVS Supply Chain Solutions IPO Lot sizes

The TVS Supply Chain Solutions IPO offers different lot sizes for various investor categories. The minimum lot size for this IPO consists of 76 shares, which requires an investment of ₹14,972. Here’s a breakdown of lot sizes and corresponding amounts for different investor categories:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 76 | ₹14,972 |

| Retail (Max) | 13 | 988 | ₹194,636 |

| S-HNI (Min) | 14 | 1,064 | ₹209,608 |

| S-HNI (Max) | 66 | 5,016 | ₹988,152 |

| B-HNI (Min) | 67 | 5,092 | ₹1,003,124 |

These lot sizes provide flexibility for investors to participate in the TVS Supply Chain Solutions IPO according to their investment preferences and financial capacity.

TVS Supply Chain Solutions IPO Reservation

The TVS Supply Chain Solutions IPO offers different reservation percentages for various investor categories. Here’s the reservation breakdown for the IPO:

- QIB (Qualified Institutional Buyers): 15.00% of the total issue size

- NII (Non-Institutional Investors): 15.00% of the total issue size

- Retail Investors: 10.00% of the total issue size

- Anchor Investors: 45.00% of the total issue size

This reservation allocation ensures that different types of investors have the opportunity to participate in the TVS Supply Chain Solutions IPO based on their respective categories.

TVS Supply Chain IPO GMP

The TVS Supply Chain Solutions IPO has been creating a lot of interest in the market, as indicated by its Grey Market Premium (GMP) of ₹25. The Grey Market Premium reflects the extra amount investors are willing to pay for the shares in the unofficial market before they are listed on the stock exchange. This increase in GMP from its previous value suggests a growing excitement and demand for the IPO, showcasing the strong investor sentiment surrounding the TVS Supply Chain Solutions offering.

TVS Supply Chain IPO Subscription Rate

As of August 11, 2023, at 7:02 PM, the TVS Supply Chain Solutions IPO had garnered a subscription rate of 1.06 times. The breakdown of subscription rates in different categories is as follows: In the Qualified Institutional Buyer (QIB) category, it is subscribed at 0.15 times; in the Non-Institutional Investor (NII) category, it stands at 1.06 times; specifically, bids above ₹10 lakhs (bNII) are subscribed at 1.19 times, while bids below ₹10 lakhs (sNII) are at 0.78 times; finally, in the Retail category, the subscription rate is notably higher at 3.78 times. Overall, the IPO is witnessing a growing level of interest from different investor categories.

| Category | Subscription (times) |

|---|---|

| QIB | 0.15 |

| NII | 1.02 |

| bNII (above ₹10L) | 1.19 |

| sNII (below ₹10L) | 0.78 |

| Retail | 3.62 |

| Total | 1.03 |

TVS Supply Chain Solutions Anchor Investors

The TVS Supply Chain Solutions IPO witnessed anchor investor participation as follows:

| Anchor Investors | Details |

|---|---|

| Shares Offered to Anchor Investors | 20,101,522 shares (45.00%) |

| Anchor Portion Size (In Crores) | ₹396.00 crore |

| Lock-in Period (50% Shares) | From August 9, 2023, to October 3, 2023 |

| Lock-in Period (Remaining Shares) | From August 9, 2023, to January 1, 2024 |

Anchor investors are institutional investors who subscribe for shares before the IPO opens to the public. Their participation is a precursor to the IPO and can influence investor sentiment. The lock-in period ensures that anchor investors hold their allocated shares for a specific duration after the IPO listing.

About Company

TVS Supply Chain Solutions is a prominent player in the supply chain management sector, offering comprehensive services to international organizations, government departments, and businesses. With a broad range of offerings in integrated supply chain solutions and network solutions, the company is positioned as a leader in this industry. Its clientele includes renowned companies such as Hyundai, Sony, and Yamaha. As it prepares for its IPO, the company’s history, capabilities, and potential for growth make it an interesting proposition for investors seeking exposure to the dynamic world of supply chain management.

FAQ

What is the TVS Supply Chain Solutions IPO?

When is the last date for TVS Supply Chain IPO subscriptions?

What is the price range for the TVS Supply Chain IPO shares?

What is the minimum lot size for the TVS Supply Chain IPO?

What is the Grey Market Premium (GMP) for the TVS Supply Chain IPO?

What is the reservation breakdown for the TVS Supply Chain IPO?

When will the TVS Supply Chain IPO shares be listed?

Latest Update

Result

Admit Card

Answer Key

SSC – Staff Selection Commission

Recent Posts

Categories

- Admit Card

- AI and Technology

- Answer Key

- Application Form

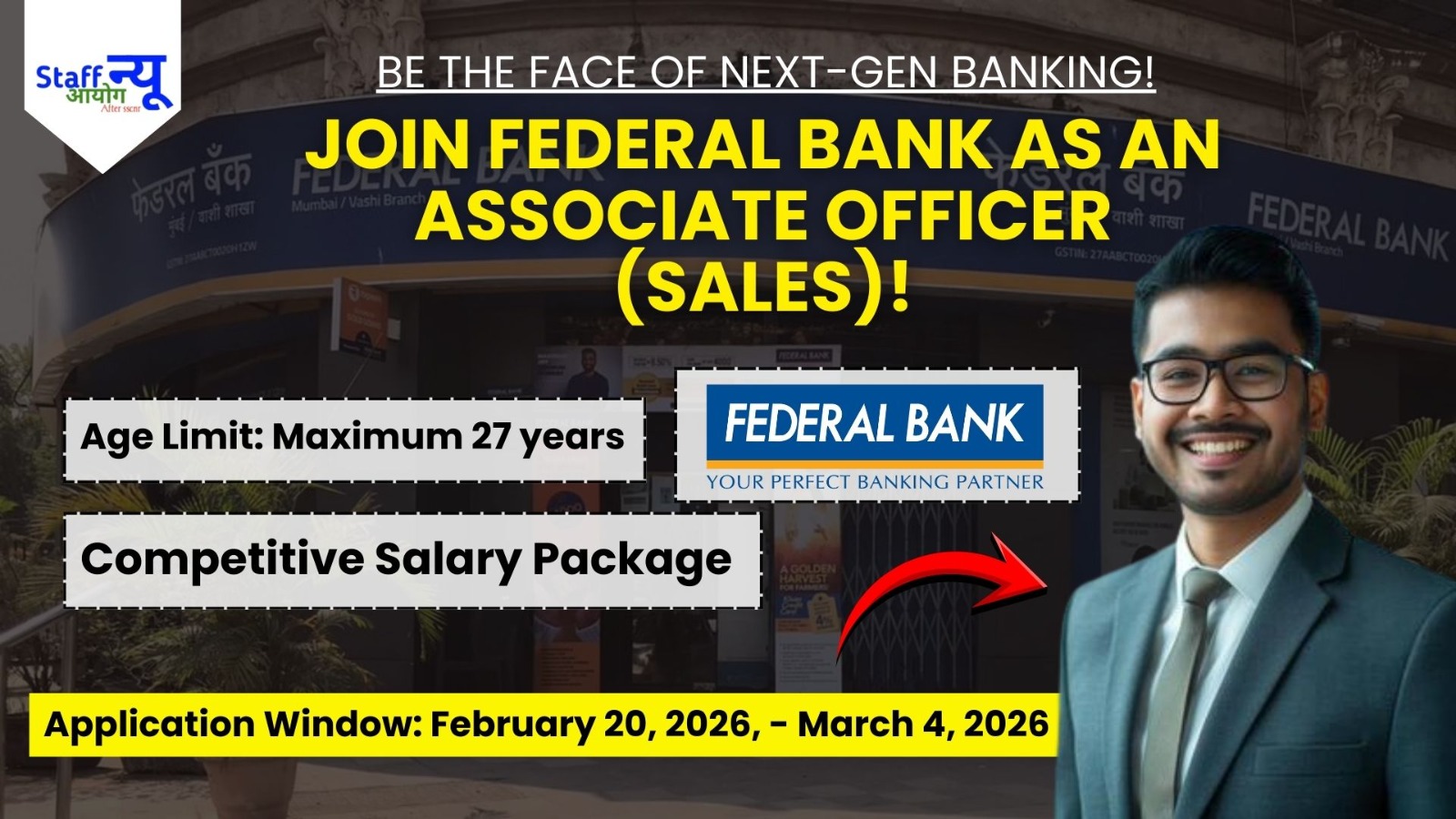

- Banking Jobs

- Board Result

- BSF and Army

- BTSC

- Call Letter

- CBSE Update

- Counselling

- Cricket

- Current Affairs

- Cut Off

- Earning Courses

- Earning Tips

- Entertainment

- Events

- Exam

- Films

- Finance

- Flood

- Game

- Govt interview update

- Havaldar and Constable Bharti

- indian railways

- IPl 2023

- Latest Job

- live score

- Lottery Results

- Marit List

- Mobile

- Net worth

- News

- Notice

- NTPC Engineering jobs

- Panchang

- Police Bharti

- Quotes

- Recruitment

- Result

- Sample paper

- Sarkari Naukari

- Sarkari Yojana

- Schemes

- Selection

- SSC

- SSC Admit Card

- SSC Answer Key

- SSC Exam

- SSC Recruitment

- SSC Result

- SSC Syllabus

- SSCNR

- Stock Market

- Syllabus

- Teacher's Job

- Technology

- Topper List

- typing test

- University Result

- UPSC updates

- Work From Home Jobs

- world record